georgia property tax exemptions for veterans

Yes 100 percent permanently and totally PT disabled veterans receive a property tax exemption in Georgia up to 150364 which reduces the taxable value of a veterans home. MV-30 Georgia Veterans Affidavit for Relief of State and Local Title Ad Valorem Tax Feespdf 30222 KB Department of.

Do Military Veterans Get Property Tax Breaks In The U S Mansion Global

Therefore it is always essential to determine the exemption you qualify to receive each year.

. Are there income tax benefits for Georgia veterans. Veteran has lostor permanently lost the use ofany of the following. Surviving spouses and minor children of eligible veterans may also apply for this benefit.

Exemptions may vary based on which county the veteran resides. Secretary of Veterans Affairs. Exemptions can vary by county and state.

There are several property tax exemptions in Georgia and most are pointed towards senior citizens and service members. Another 17500 of retirement pay would be exempt for. This is a great program and a fitting way to honor a great Georgian.

Under the measure a veterans first 17500 in retirement pay would be exempt from Georgias state income tax which has a top rate of 575. Surviving spouses and surviving children may also be eligible for this property tax exemption. Veterans who make under 21000 may also qualify for additional exemptions of up to 2000.

A property may be eligible for exemption in a few different ways including based on the existence of a homestead whether its used as a place of worship and whether its owned by a veteran. To qualify for the exemption the veteran must own the property and must have a 100 Permanent and Total PT VA disability rating OR have been awarded Special Monthly Compensation by VA for 1 The loss or loss of use of one or more limbs or 2 Total blindness in one or both eyes. Here are some important things to remember about property tax exemptions.

Per Georgia law Disabled Veteran or Surviving Spouse rated 100 disabled or 100 IU are qualifying disabled veteran that may be granted an exemption of 60000 plus an additional sum from paying property taxes for county municipal and school purposes. Property Tax Exemptions for Veterans. One or both feet.

A property tax exemption is the elimination of some or all of the property taxes you owe. Georgia provides 100 disabled vets a property tax waiver of at least 50000 on their primary residence. All Veterans can receive a 17500 tax exemption on their military retired pay.

Exemption from Homestead Tax 100 disabled veterans those getting VA disability for loss of vision or limbs and their surviving unremarried spouses may be exempt from property tax on their homes. Veteran is deemed 100 percent disabled per VA assessment. A letter from the Veterans Administration stating that the veteran has a 100 Service Connected Disability and is totally and permanently disabled is required to qualify for this exemption GA Code 48-5-48.

This commonsense bill gives Georgias hardworking taxpayers the opportunity to donate all or a portion of their annual tax refund to scholarships for disabled veterans through the Technical College System of Georgia Foundation. Not all veterans or homeowners qualify for these exemptions. A disabled veteran can also be exempt from paying property or title tax on any single vehicle they own if their disability meets one of the following criteria.

Common exemptions include Veteran Disabled Veteran Homestead Over 65 and more. There is a 1250000 exemption for the County portion of the tax bill. The exemption only applies to the original grant under OCGA.

Georgia offers a homestead property tax exemption to the Surviving Spouse of a Service member that is killed or dies as a. One or both hands. Disabled veterans can.

Georgia Tax Exemption for Military Retired Pay. In 2022 the additional sum is 93356 according to Georgias Department of Veterans Service. Georgia Tax Center Help Individual Income Taxes Register New Business.

Georgia offers Veterans a tax exemption for up to 35000 of their military retired pay. Homeowners must apply between January 1st and April 1st. Veterans with a service-connected disability are eligible for an exemption from sales and use tax for the purchase and special adapting of a vehicle provided the veteran receives a VA grant for that purpose.

Unclaimed Property X About DOR Office of the Commissioner Press Releases Hearings Appeals Conferences. For veterans without a disability there is a basic 1000 property tax exemption. 12500000 is subtracted from your assessed value before your bill is calculated.

The Local Homestead Exemption is available to all homeowners 65 and older with a net income of less than 1000000. Qualified veterans in Georgia may receive a property tax exemption for a primary residence of up to 50000 plus an additional amount which varies annually. You may be required to renew your exemption benefits annually.

A disabled veteran in Georgia may receive a property tax exemption of 60000 or more on hisher primary residence if the veteran is 100 percent disabled depending on a fluctuating index rate set by the US. To be granted a property tax exemption in Georgia you have to be the owner of the property from January 1 of that taxable year. Disabled Veterans S5 - 100896 From Assessed Value.

The exact rate changes depending on the fluctuation rate set by the Secretary of Veterans Affairs.

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

Get Paid To Complete Offers At Treasuretrooper Com Offer Completed Paying

Property Taxes Calculating State Differences How To Pay

Respect The Flags Respect The Flag Safety Topics Dig

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

What Is A Homestead Exemption And How Does It Work Lendingtree

I Also Have Friends Who Dont Have To Pay Property Tax After Getting Medical Disability Does Fox News Want This To Go Away R Military

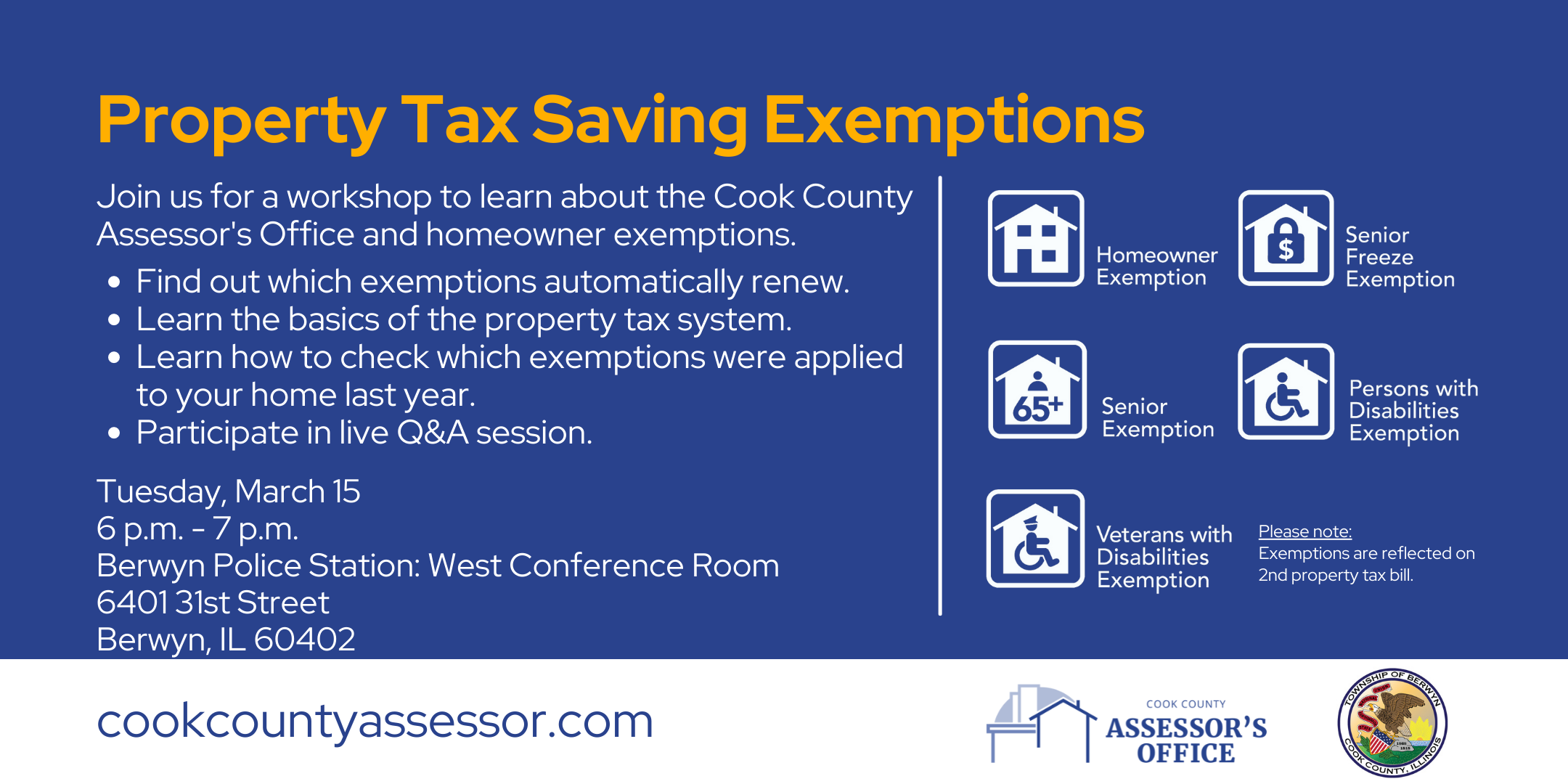

Property Tax Exemption Workshop Berwyn Township Cook County Assessor S Office

Find Out If There Are Any States With No Property Tax In 2020 Which States Have The Lowest Property Taxes States Property Tax Property Real Estate Investor

States With Property Tax Exemptions For Veterans R Veterans

Property Taxes By State In 2022 A Complete Rundown

Property Taxes Calculating State Differences How To Pay

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

The Ultimate Guide To North Carolina Property Taxes

Suffolk County Legislator Rob Trotta Reminds Residents To Apply For Enhanced Star Tax Exemptions Before Deadline On A Frame House Kits A Frame House Homeowner

Property Taxes By State In 2022 A Complete Rundown

Veteran Tax Exemptions By State

Principles For The Design Of The Real Property Tax Springerlink